Janet Yellen: Creature of Chaos

(Note: While those who have access to The Daily Doom got part of the following article as the intro to today’s edition, I felt the general picture of deep market unrest that the intro laid out from today’s news headlines reveals a level of chaos now surging beneath global markets to such an extent I feel compelled to share it with everyone; and, you know me, I had to build on it. It also provides content for all as I continue to work on my next Patron Post, which goes more in-depth on whether the new “not bailouts” are actually QE and what impact they will have on inflation.)

Just a handful of recent bank collapses … with the boost given by Janet Yellen’s recent testimony in congress … have spread shockwaves beneath the entire surface of global banking. The fault lines are no longer merely cracking open beneath zombie corporations like Credit Suisse that have fallen into them, but are spreading in contagion from Credit Suisse and from Yellen’s testimony, though ultimately from the program she helped create.

A bad case of the runs

Several publications are now joining in the harsh criticism I brought against Yellen immediately after her testimony when Senator Lankford pointedly revealed the bank runs being created as widespread contagion due to the bailouts Yellen arranged with Jerome Powell, Joe Biden and the FDIC, which applied only to top-tier US banks. (See: “What a Day! The “Non-Systemic†Collapse Deepened Systemically.”)

One could easily see that Yellen, who looked like an opossum caught in the headlights, was being informed for the first time about the trouble her rescue program had created, and that she had no answer prepared for it (as she usually relies heavily on her prepared answers). Suddenly she gets it, so we see her in the news today feverishly paddling ahead to stop the spread of panic by assuring everyone the government could do the same thing for smaller banks if it needs to and that the government is working on how to do that right now.

That only goes to prove the Fed, FDIC and Treasury had no idea this problem would emerge then. The one alternative is something worse: It was a dastardly plot to funnel billions from small banks into the Fed’s favorite banks — the main owners of the Federal Reserve system, which, YES, is owned by all the national banks that participate in the system. Then, since Lankford brought the insidious destruction that is being wrought by the design of this program, the players had to go into overdrive to look like they’re doing something to resolve the problem. (You can take your pick because either way the problem that matters to me is the destruction their program is creating — large enough that they, for whichever of those two reasons, now have to scramble to figure out how to resolve it.)

Here’s the thing: Yellen’s pablum is likely too little, too late because, by the time the government “needs to” make the deposit guarantees apply to all banks, the contagion will have spread through hundreds and hundreds of small banks as their best accounts are migrating as quickly as possible into the nation’s largest banks. Today’s headlines show how great that concern has now become.

By the time the government establishes a broader program, as Yanet Yellen now now assures us the government is rapidly working on, smaller banks will have already lost so many of their prime accounts that they will be seriously weaker forever. (“Forever” being cut short only if they collapse.) In other words, even if Yellen’s and Powell’s and the FDICs attempt to broaden the insurance-without-limits to all depositors I all banks in order to stop the runs, the damage of lost deposits still hurts all of those smaller banks from this tie forward. Think about it: Is there anyone who believes that, after the banks’ client businesses go through the trouble of moving millions of dollars along their automatic payments they have set up for payrolls and payroll taxes and benefit plans and all the sophisticated arrangements they each set up with hundreds or thousands of vendor accounts or customer accounts tied to their accounts … that those banks will, just because the government has fixed the insurance problem it created, suddenly move all their money back to their regional or local banks? It’s not an easy move.

So, zero chance. The damage is already happening, and no one knows how extensive it is, except that today’s news reports that already 25 more banks are in serious trouble due to the same issues that brought down SVB, which happened because of the Fed’s misguided belief that it can reduce its balance sheet and raise interest rates enough to tackle inflation and because of the banks’ inattentiveness to dealing with that massive regime change in the banking world.

You can be sure some, if not all of those 25 banks, have seen their situations made much worse last week by the run created by Janet Yellen’s testimony (although ultimately by the reality of the program she helped create). Suddenly, all clients of all banks are aware a run is in the making, so they must move swiftly. However, none of those banks being hit by this are going to reveal the impact until they are facing insolvency and have to reveal it, lest they make their own runs worse.

Yellen, in the meantime, continues today to reassure everyone that the US banking system is sound — because she has to. Her reassurance claims the present situation is nothing like the banking bust in ’08 on the basis that 2008 was all about solvency in banks due to their taking on low-quality mortgage-backed securities, whereas the present crisis is merely due to “contagious bank runs.”

Oh, I feel so much better to know that the individual banks that are now clearly plunging into insolvency (or they wouldn’t have been dissolved) are going insolvent because they are suffering from the kind of thing that plunged the world into the Great Depression — good old-fashion “contagious bank runs.“

We ALL already know that the runs at these banks were created by a completely systemic bond-value-reduction that was caused by the Fed for all banks. We all know this bond devaluation by Fed policy effectively rendered those “safe-haven” instruments just as un-tradable for banks as junk mortgage-backed securities were in ’08. While they are a different kind of supposedly safer instrument, they have been substantially devalued all the same. Because that imperils the reserves of all banks, the Fed had to create a new loan program available to all banks. Now, we appear to have, additionally, another systemic bank-run issue percolating beneath the surface being caused by the rescue program because it gave sweeping depositor insurance to ONLY the top-tier banks.

What a mess! We’ve solved a case of the runs with an enema for small banks that is driving their depositors to large banks, so now we’re being assured the Fed and feds are working on a solution to the solution. The present situation was, in other words, created because the Fed was too dumb to see it was creating a liquidity problem in bank reserves (its main bailiwick); so, we should rest assured “the US banking systems is sound.”

What a slough of bilge water is pouring out of Yellen’s mouth. Yellen, of course, has to say such things because, if she spoke candidly about the concerns sweeping through banks, her words would become a self-fulfilling prophecy. She cannot risk creating a larger panic. I’m just saying pay no attention to someone who is merely saying what her position requires. She tells you the system is fundamentally sound, as she has claimed wrongly every day so far, as she assures you she is doing her utmost to fix the unsound parts of it. Anyone feel a little cognitive dissonance there? If they have to tell you again every day the system is sound, then it is not sound because the whole system rests on confidence alone.

Switzerland slips on itself and becomes an overnight “banana republic”

Add to all of that the AT1 bond crisis that is blowing through Europe in today’s headlines. The Swiss solution to Credit Suisse’s longterm problems, which blew wide open when the tremors from the US fiasco passed under its failing foundation, has turned the most solid banking nation on earth overnight into what is now being heralded in international headlines as a “banana republic.” Some are saying Switzerland has forever destroyed its good-as-gold global banking reputation.

Because those new fears about bonds immediately spread in shockwaves throughout the Eurozone, Europe is scrambling in today’s news to make it clear that Switzerland is not a part of the Eurozone, and that the Zone does not have the same kind of AT1 CoCo bonds that Switzerland allowed. Those bonds, upon deeper inspection, had buried catch clauses that said they could be sacrificed right along with stocks. (Wolf Richter does a good job of explaining all of this.)

However, no one holding those bonds — even those aware of the catch clauses — ever thought that provision meant shareholders would retain some value in their shares while the bond holders would absorb 100% loss. They, at least, thought the sharing of losses would be equal between those bonds, which paid high yields, and shares. Apparently, nothing in the clauses indicated the bonds would be so completely subordinated to shares that they would absorb everything before shares absorbed one cent. So, the action may have been legal based on the clauses, but it was completely unexpected in that bond holders anticipated, in the very least, equitable treatment with shareholders in bearing the loss.

Flush!

According to today’s news, the AT1 write-offs at Credit Suisse have caused its Saudi creditor, at least, a billion dollars in losses and have caused PIMCO hundreds of millions in losses. While these large institutions have other areas of profit that can offset those losses, so they will survive, how many other smaller institutions are at risk of contagion because they had a lot of Credit Suisse AT1 bonds that just got flushed away completely with the outgoing tide? It is not like you have to lose 100% of your cash-paying assets to suddenly become insolvent! A mere loss of 20% may get you there.

It kind of leaves one wondering how much that other behemoth European bank, Deutsche Bank, might have swallowed of corrupt Credit Suisse’s AT1 indigestible bonds. The equally corrupt DB will now have to write off in full any of those it has, and DB doesn’t have much room to take on more bad news. As bad off as Germany’s stinking wretch of an ancient zombie bank is, it wouldn’t take much for the fall of CS to become the last straw for Deutsche Bank just as the fall of the much smaller and far-removed Silicon Valley Bank & Co. proved to be the last straw for Credit Suisse. In that event, crisis spread all the way from the US to Europe through mere fear and the rising stench of death. How much easier for the spores of this insidious bank rot to spread from Switzerland to neighboring Germany.

The global banking system has remained riddled with the fault lines of corruption, thinly stretched leverage, sleeping (or paid off?) regulators and a justice system that never took action against banksters after the Great Financial Crisis. That left a landscape of moral-hazard land minds. All of that was perpetuated with bailouts of slimy things like CS that should have perished way back then.

That unending greed led to the creation of perilous new instruments of death — first MBS, now these AT1 bonds with their little surprise. In such a wobbly system, a relatively small shakeup in one place can conceivably shake down the entire system, especially when it is being weakened by the rapid withdrawal of central-bank money. One wonders if Deutsche bank will not have to wait long to become the next to fall, and think of the damage that systemic collapse of the world’s oldest and largest bank would cause!

Assurances are given because assurances are needed

Where the Yellen contagion goes in bank runs at small and medium-size banks is a mystery until we find out in the next week or two which banks lost enough of their major depositors in this latest and ongoing flight of capital to create a serious run issue and a permanent loss-of-revenue issue. When you’re a small bank losing your biggest clients, just losing 2-3 could be a bigger run in dollars you have to cough up (and loss of future service fees) than a bank can manage. Suddenly the bank has to raise capital, and that becomes a solvency problem.

Where the AT1 bond contagion goes is also a mystery until we find out who was heavily invested in Credit Suisse in order to know where the next dominoes from the 100% wipeout of those bonds will fall and then wait to see who they fall upon.

All of this was just a massive foreshock in a few banks that have now loosened up the entire fault system to where everything is trembling beneath the surface. Sometimes the aftershocks are bigger than the foreshock.

In the following video of today’s banking summit, Yellen, after her speech, clearly reads her prepared answers off a script to what were, therefore, prepared questions given to her in advance to make sure there were no surprises for her as happened in congress. This was her chance to get out the assurances she wanted to share … and nothing else …. directly to the nation’s concerned bankers. It’s also clear she has her Biden-admin talking points in hand.

Her speech and answers attempt to justify the rescue operation that is causing runs, though she uses the word if. That is because the solution deployed is begging for justification and causing the need of additional reassurances, of which she provides a repetitive supply today because they are necessary. If you decide to listen to Janet Yellen’s blather to bankers, keep a barf bucket beside you:

We are ready and prepared.… We have the safest and most liquid financial system of any in the world.

Good to know because you certainly weren’t prepared until now, and things didn’t look too liquid in the last couple of weeks where normally liquid assets were rendered illiquid by Fed tightening that it cannot do but has to do if it wants to end inflation.

With …

- inflation back to rising

- and a Fed that has already tightened against inflation to the breaking point,

- the Fed’s balance sheet back to soaring because it has to to save the banks the Fed crushed

- and an economy teetering on a second dip into recession after having had a “technical recession” for the first half of last year,

- housing back to collapsing

- and stocks in tremors with a lot more reasons to cave in than to rise,

- a bond market going bust

- and now banks going bust with it …

… it should be a cherry of a year!

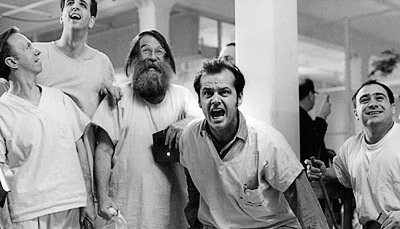

Thank goodness we have experts in charge of this asylum.

Remember that, as recently as the close of 2021, Jerome Powell assured the rest of us inmates that the inflation rate for 2022 would be 2.3% and that it would fall to 2.1% for 2023. Thank the Fed, in whom we apparently continue to trust, the reprieve of 2023 has finally arrived! (Always trust the assurances if denial helps you feel better. Unfortunately, that doesn’t work for me.)

Rather than letting Yellen have the final quote, I’ll close with Havenstein’s Razor:

Never attribute to malice that which is adequately explained by stupidity, unless it keeps happening over and over.

Leave a Reply